Beema

Motor Funnel

ABOUT THE PROJECT

From MVP to MLP

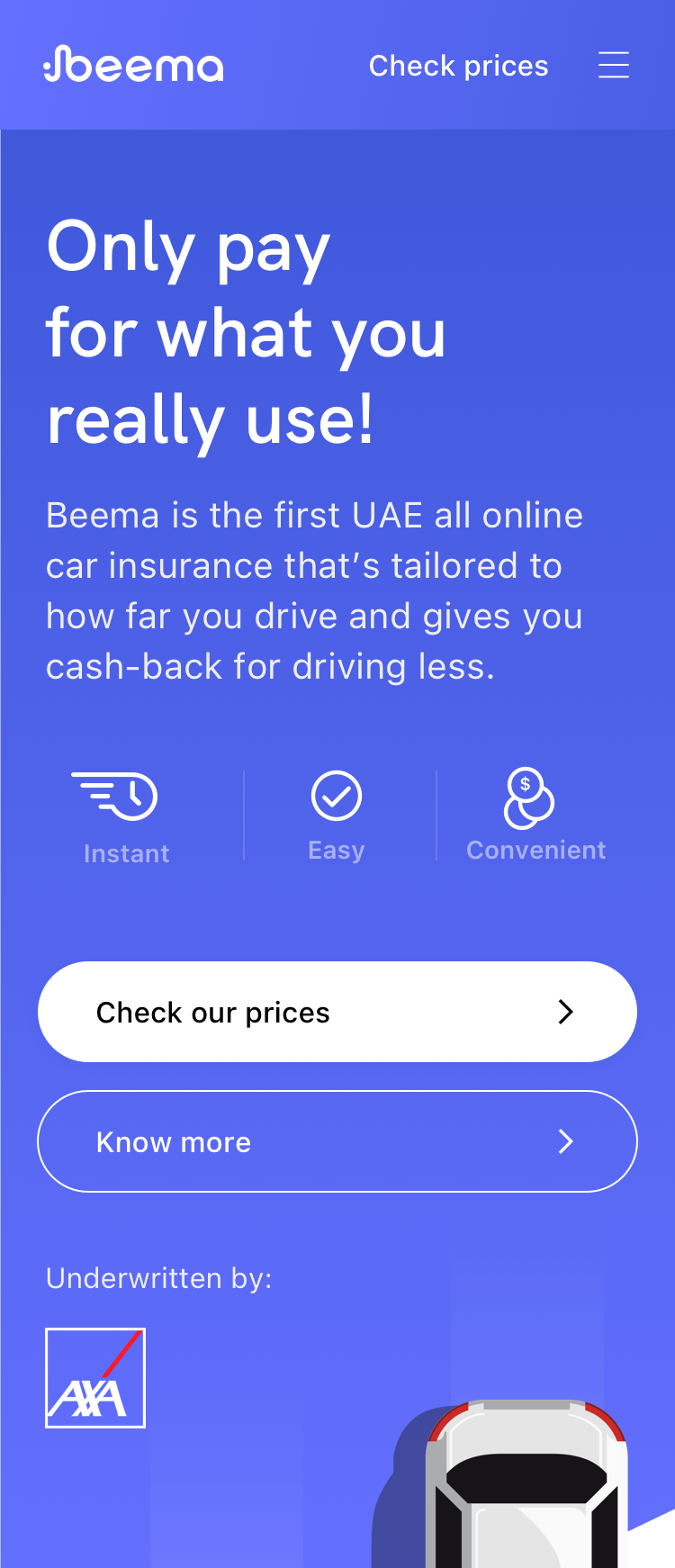

In 2019 Beema was launched in the UAE market. I joined the company a few months after to help with the migration from the MVP to a more complex and scalable product.

I chose the Design Sprint Methodology to align business goals and stakeholders’ expectations.

This is how I did it.

Highlights

01

📉

Low conversion rates

02

🧑💻

Slow release time

03

🤷🤷♀️🤷♂️

Unaligned stakeholders

01

The Challenge

Becomin Agile

The product was online, but releasing new features was extremely hard and time-consuming. The MVP was ok, but it was not built to be scalable. Being in an agile team we needed more flexibility to deliver things quickly and constantly.

The engineering team decided to migrate the code to Ruby, and I took the opportunity to collect some feedback from real customers on how the product was performing and redesign part of the funnel.

The funnel was not 100% user-friendly: a long list of questions was asked at the same time, resulting in a high drop-off of customers on the first part of the journey. Plus, our value proposition (pay per kilometer/cashback insurance) was not clear enough.

02

Design Sprint

The team

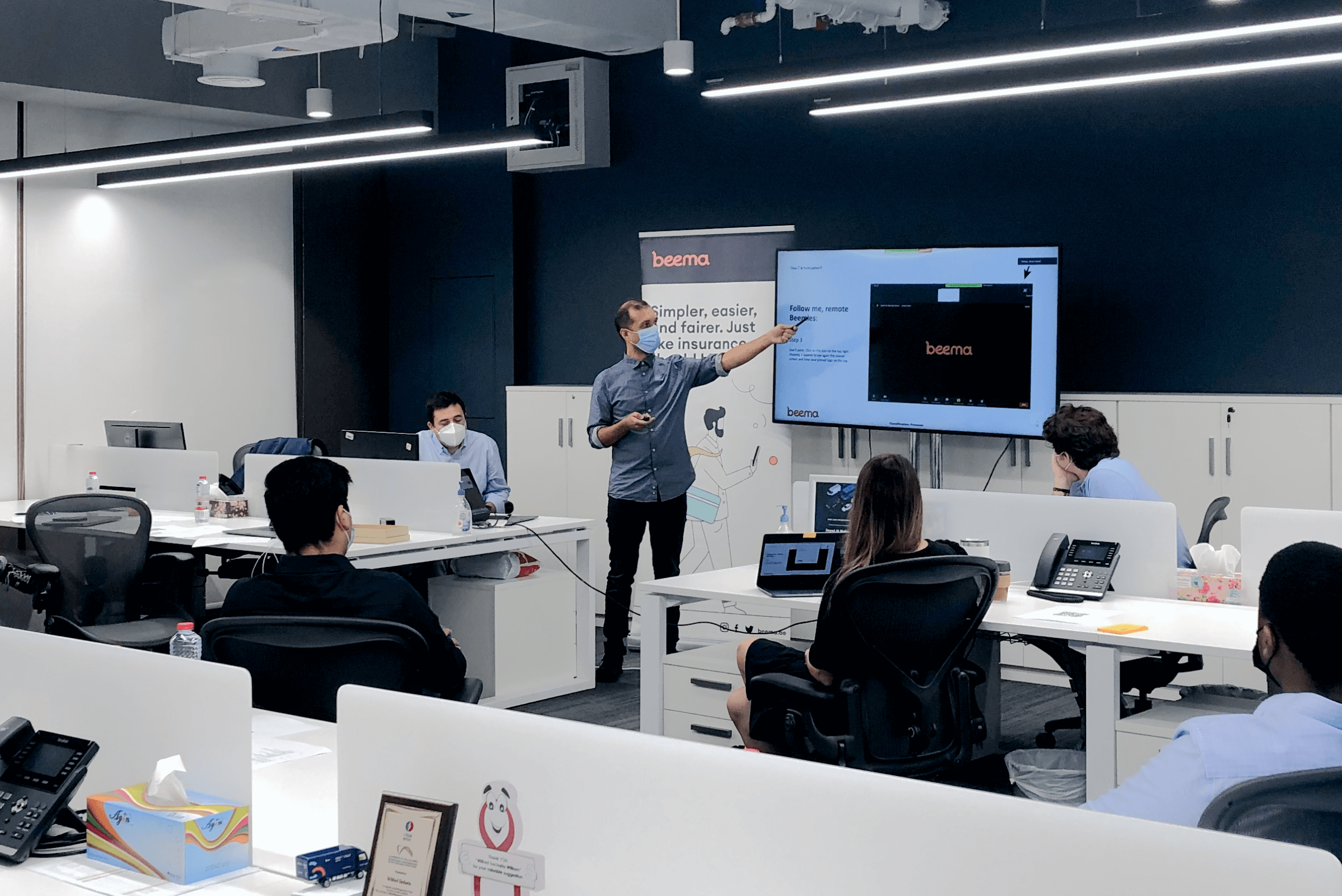

To do that quickly, I decided to run a Design Sprint involving the Head of Engineering and some developers, the Head of Product, the Head of Design and all the designers, and a couple of people from business and operations.

Sprint Goal

“Design a start-to-finish purchasing journey that the customer can follow end to end in a short amount of time. Simplify the journey, guiding the customer as much as possible during the process.”

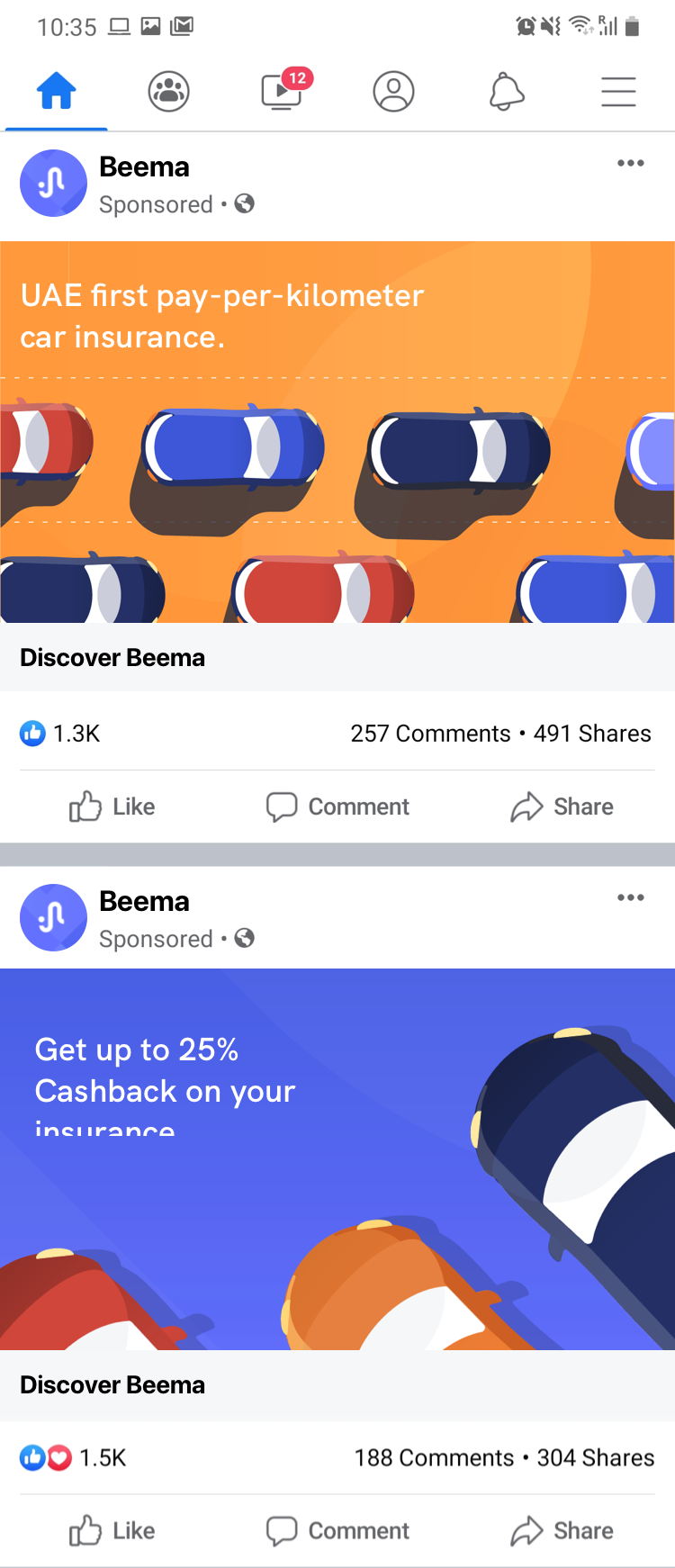

In fact, one of the main obstacles we needed to overcome was the lack of trust that customers of the region have for end-to-end online processes, especially when it comes to insurance. Having a 1-1 conversation with a human being in order to bargain price was still a common practice, and we wanted to increase trust in customers to convert as many leads as possible without relying only on customer service.

How mighht we

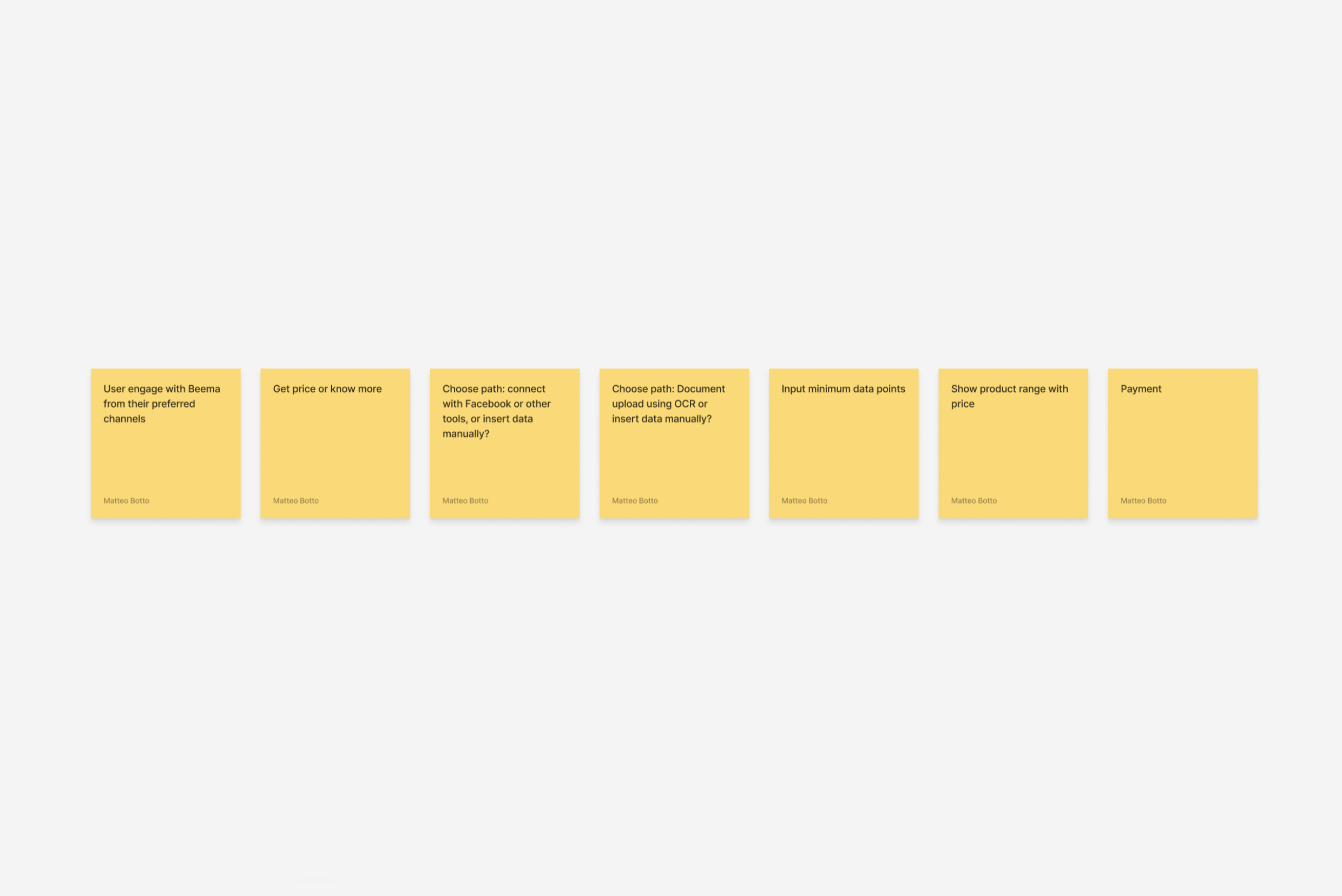

These are the main questions we wanted to answer

- How might we clarify the value proposition to our customers online? Pay per kilometer and cashback are still confusing concepts for them.

- How might we advise users on what they need (help in decision-making)?

- How might we build an all-online experience that works well for an online-offline-online journey?

- How might we give prices to customers very quickly, regardless of how much info is shared by the customer?

- How might we provide a user experience that suits the customer’s needs/habits/expectations?

- How might we reduce manual data entry for the users?

03

Solutions

Voting

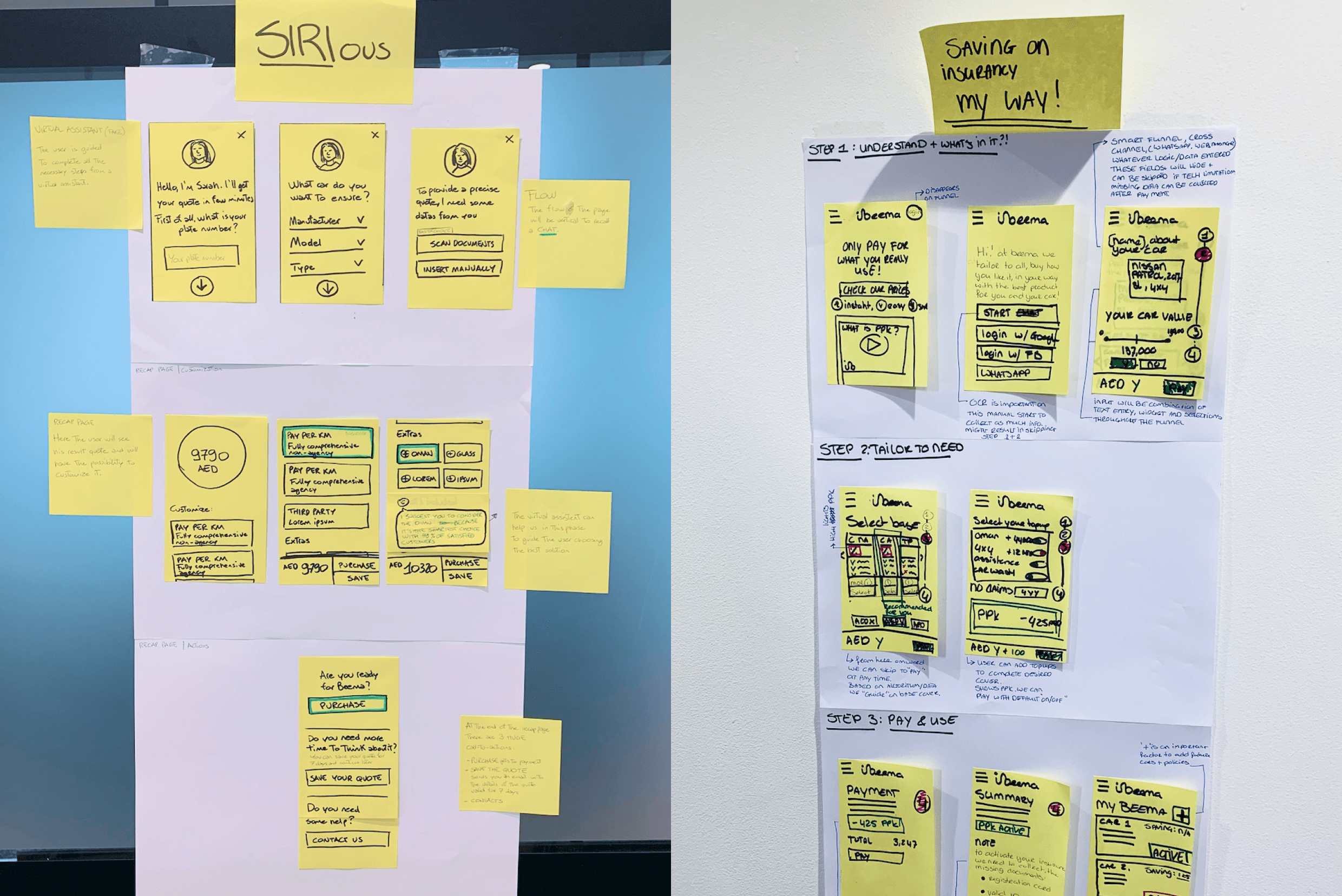

After designing a high-level flow, we sketched some solutions. Two of them were voted on and used to create a quick prototype to test with 5 users.

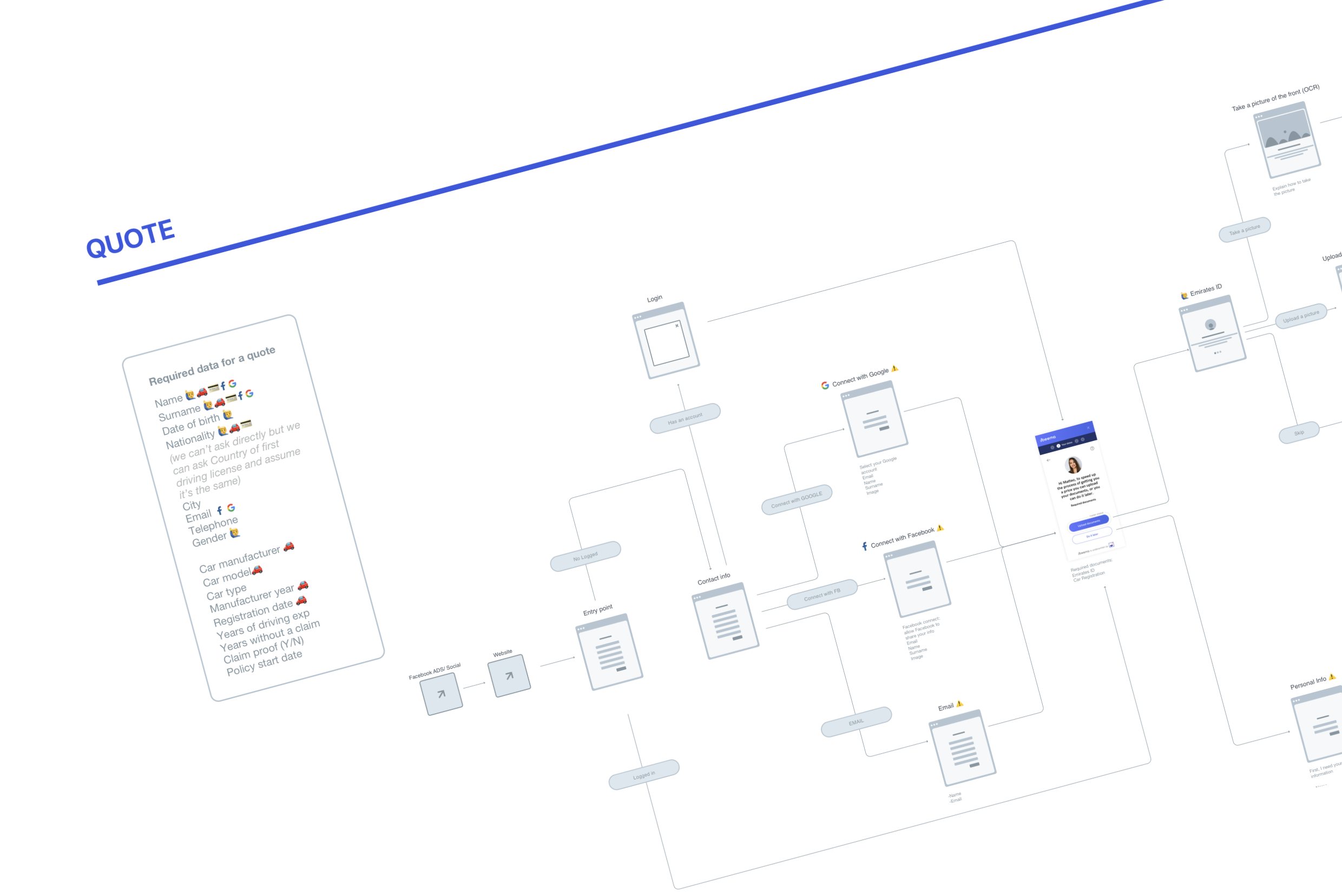

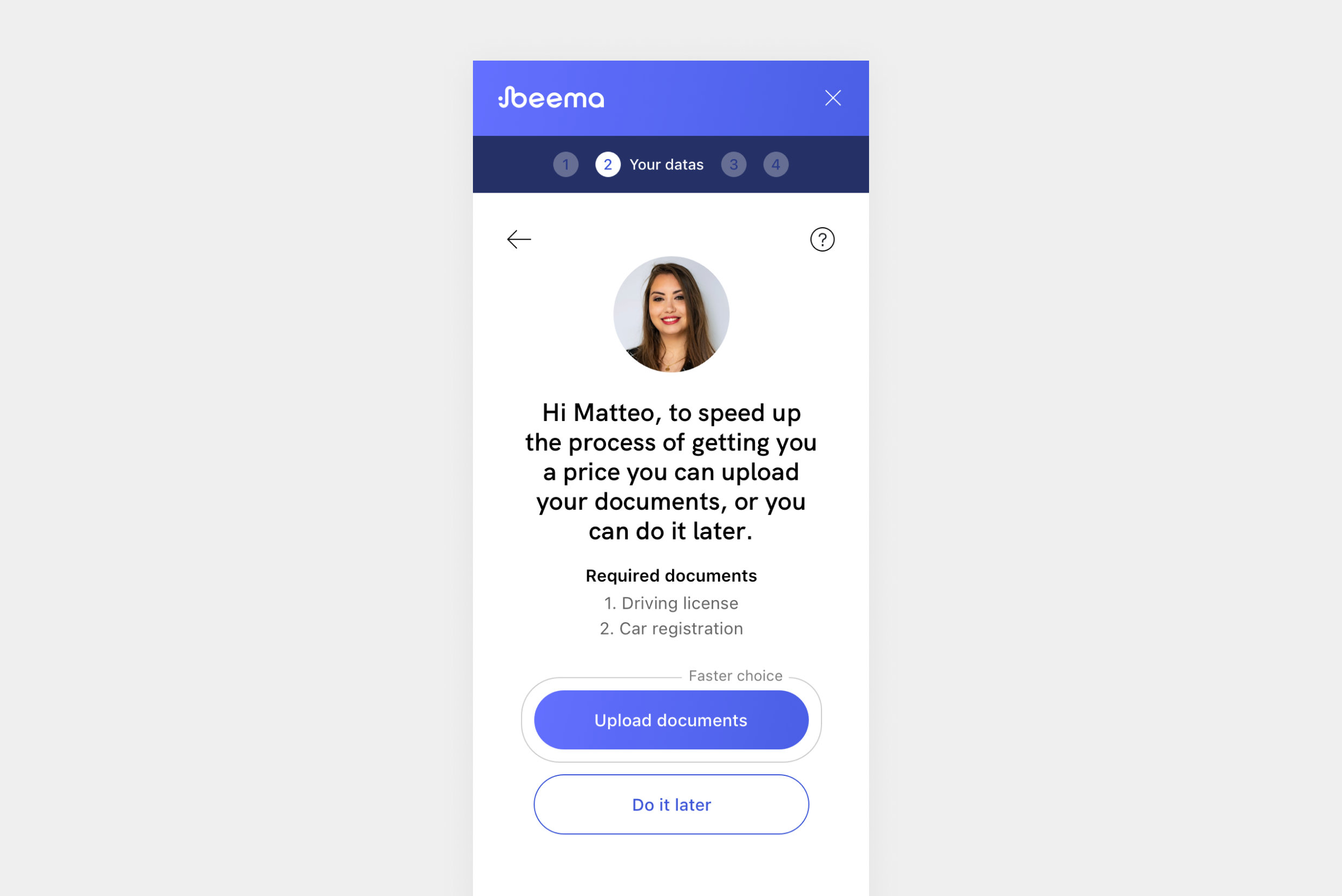

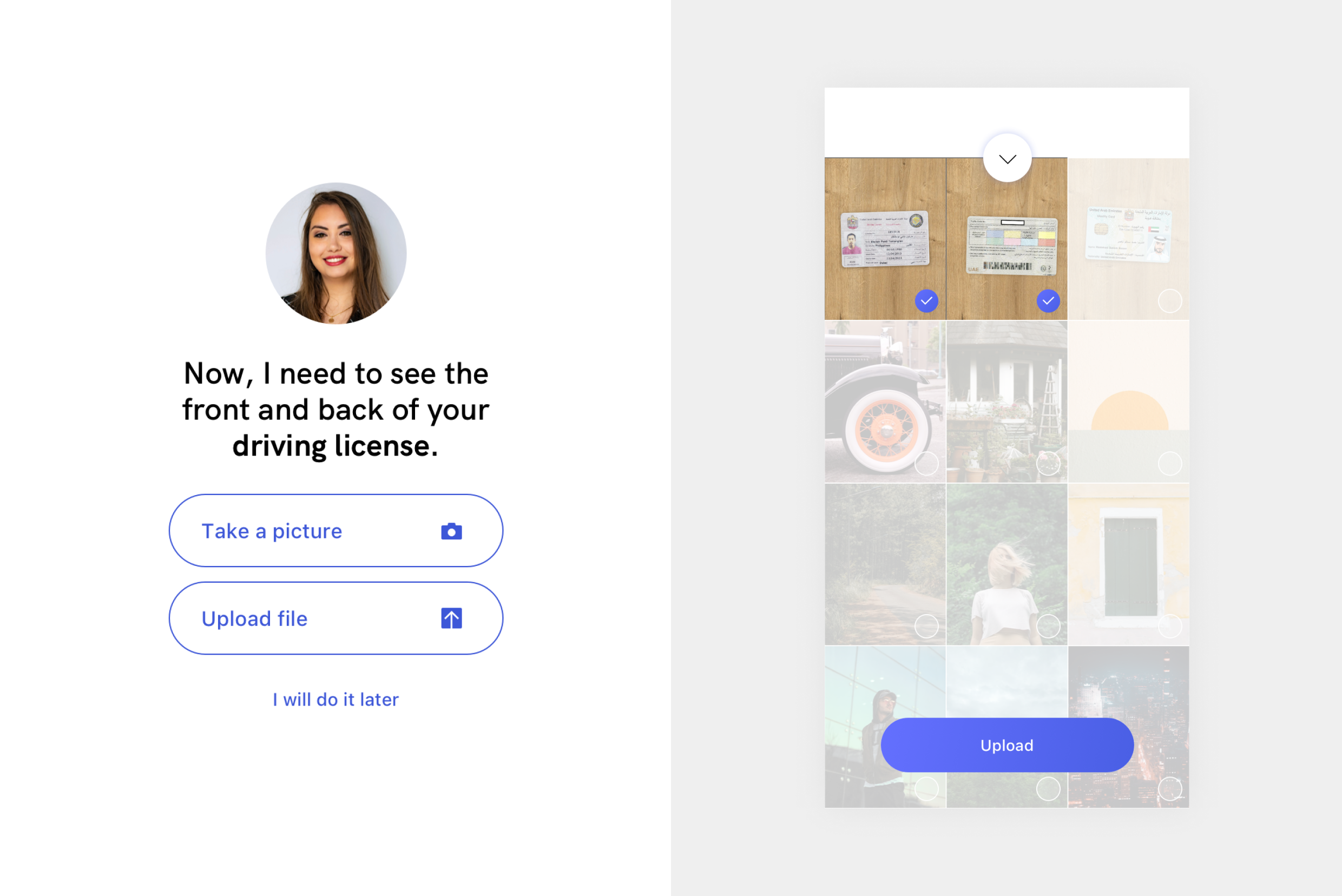

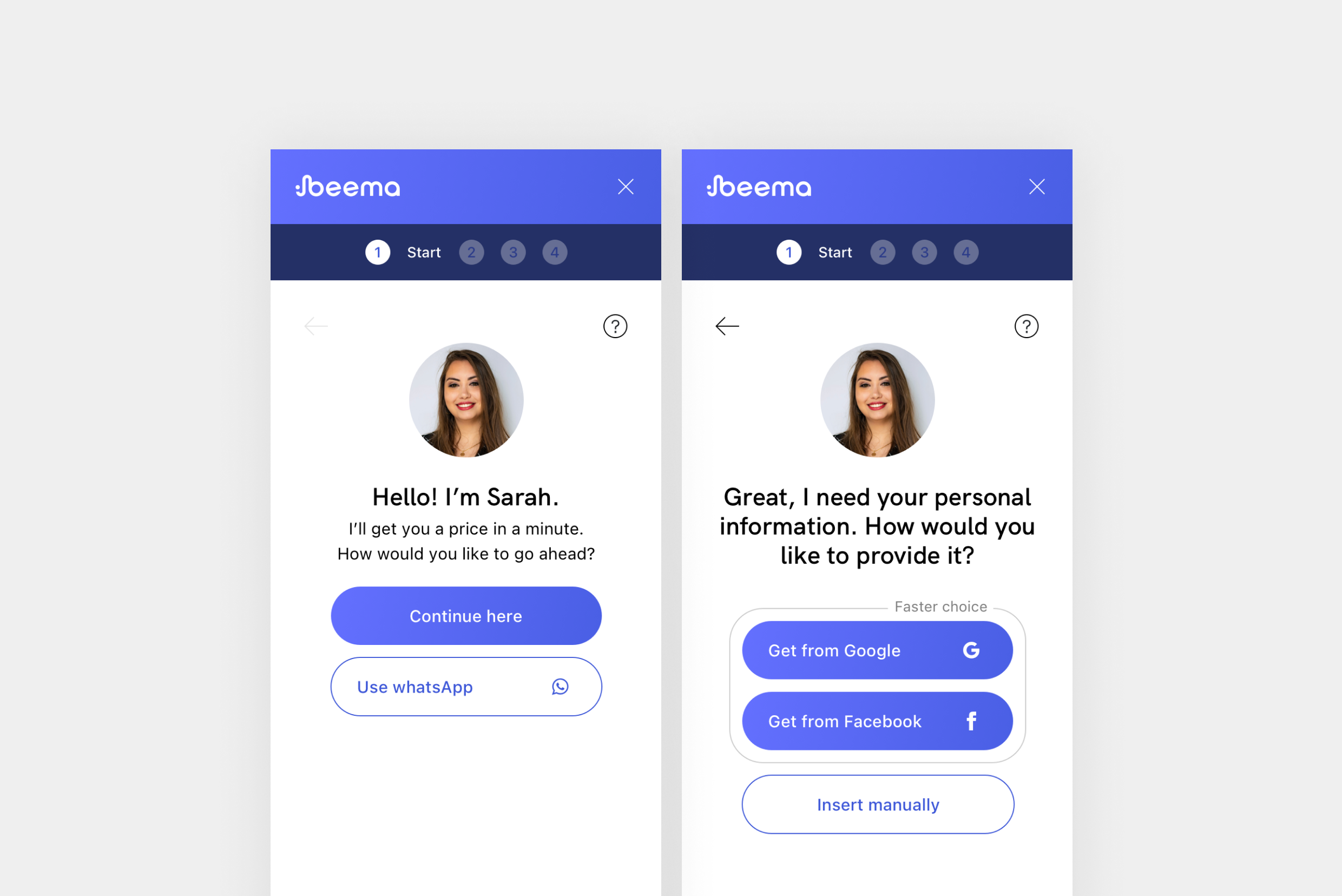

1) A multiple path journey with variable length depending on how the user decides to provide his data (insert manually, connect with Facebook, upload documents with OCR).

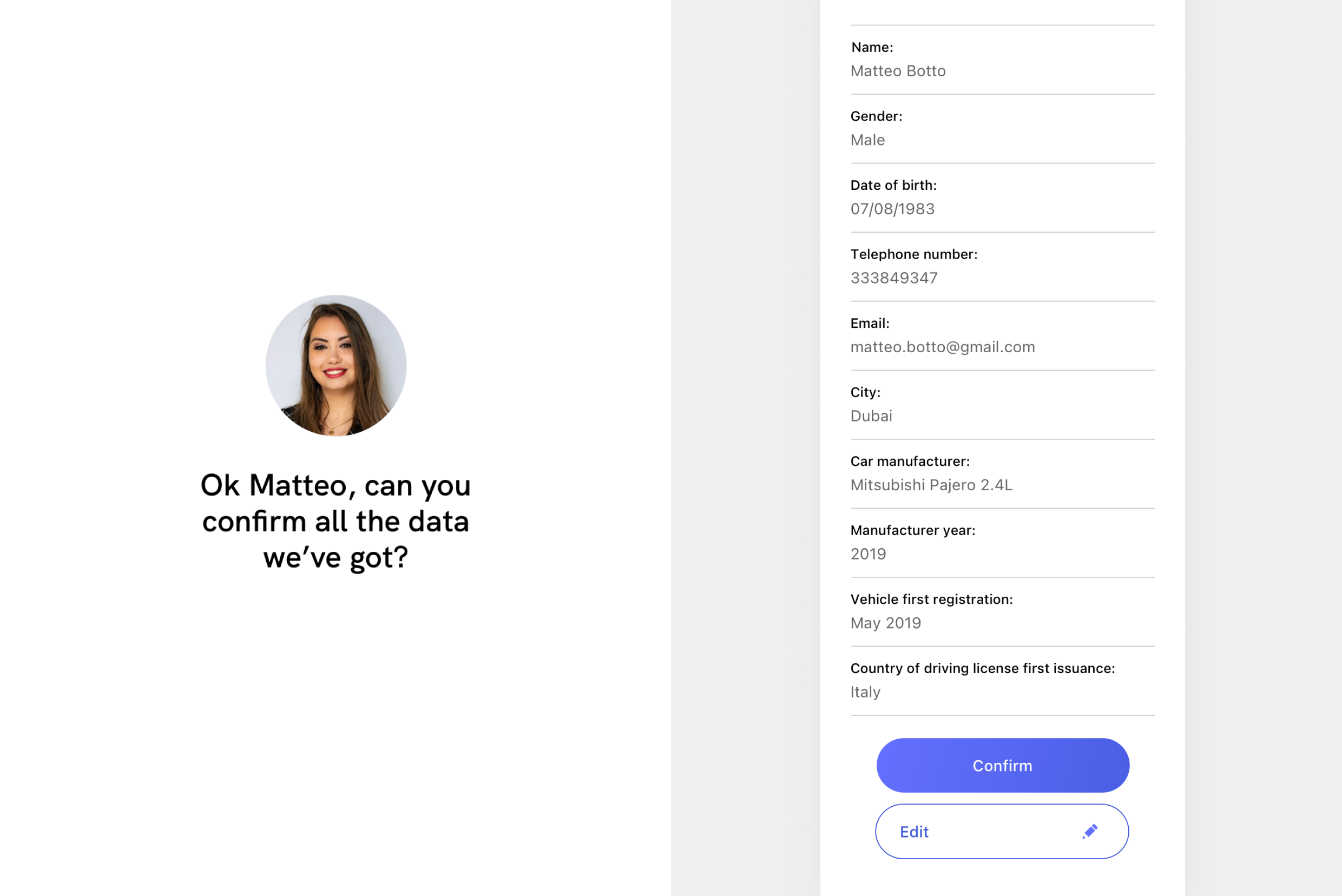

2) A journey built around the user’s choices.

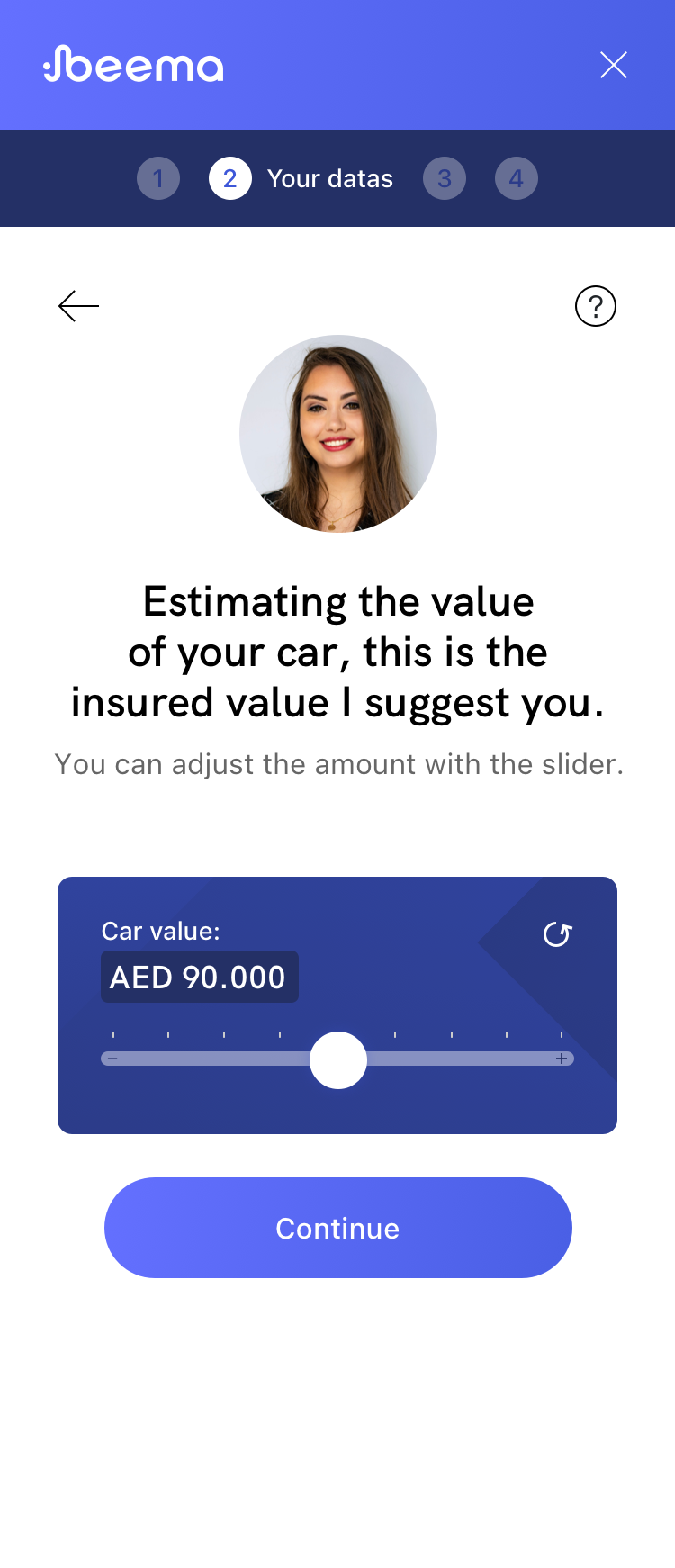

A chat-like experience that mimics the interaction between the user and the broker.

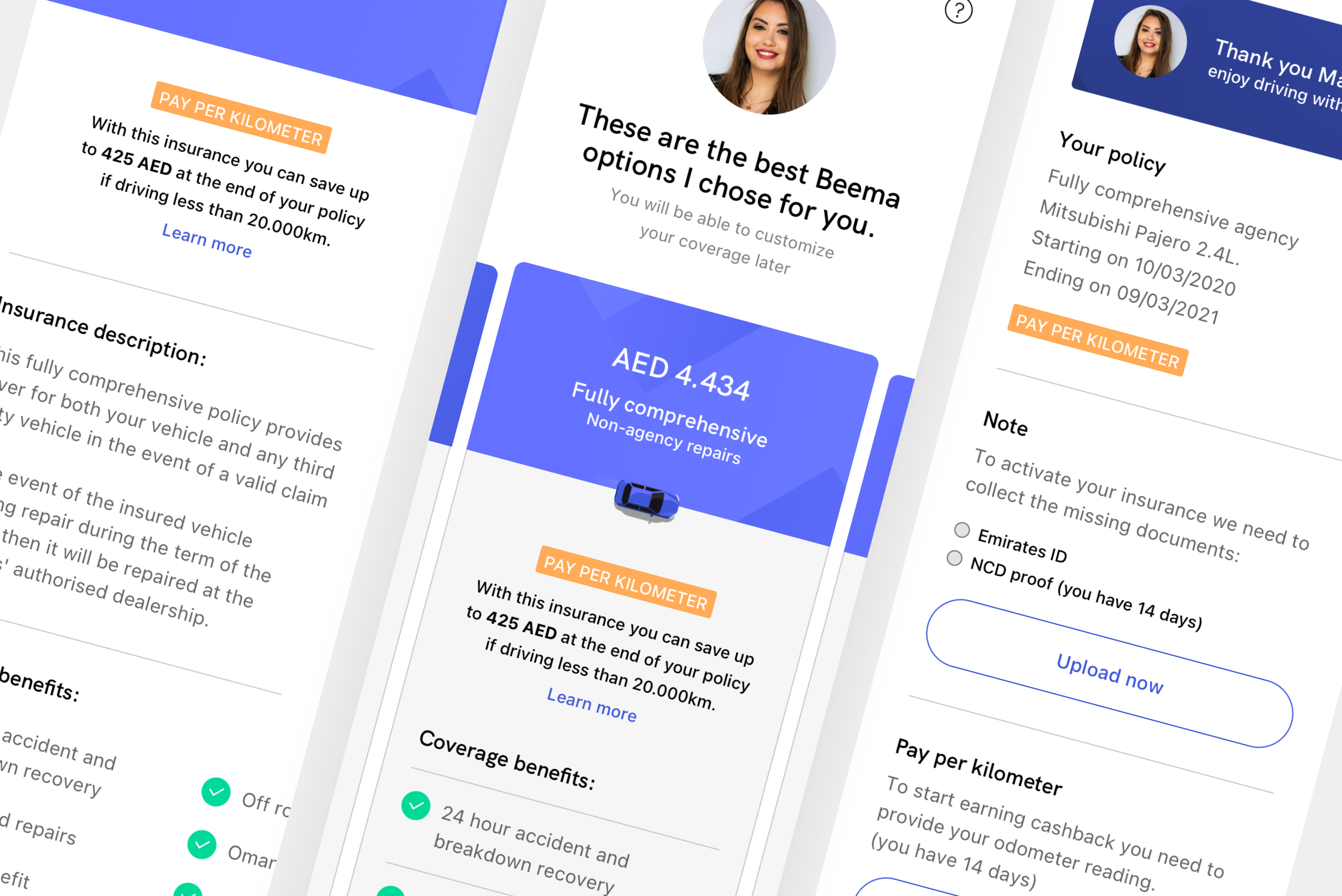

How can we make the value proposition more clear?

By explaining the value proposition during the quote and purchase phase and giving the possibility to know more about PPK and cashback during the process without dropping off.

How can we help the user in decision making?

We decided to add suggestions in each critical step of the journey to help the users to speed up the quotation process.

How can we reduce manual data entry for the users?

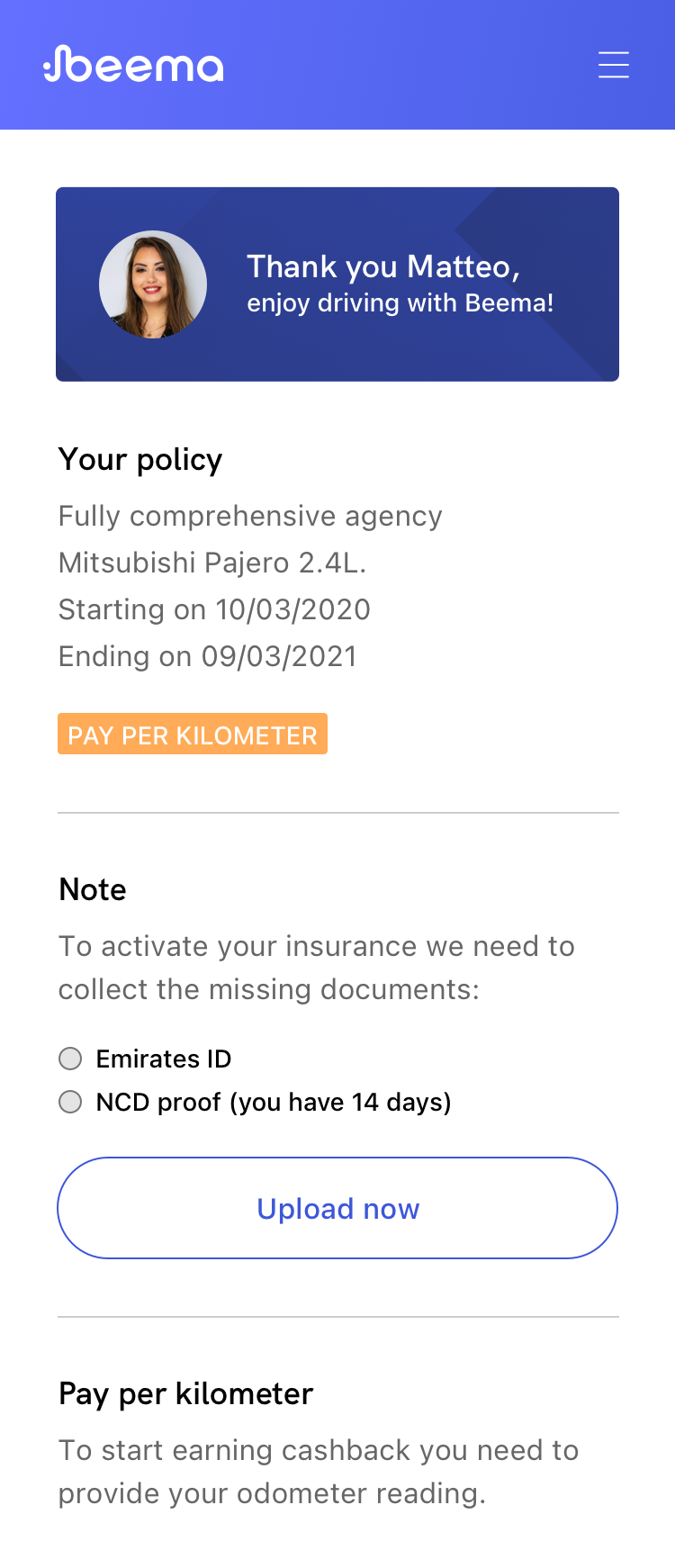

Document upload and OCR, quotation process shrinked to the minimum (less information and less data fields). Less steps from start to end.

How can we provide a user experience that suits the customers’ needs/habit expectations

We gave the user the possibility to choose between different paths (upload documents manually, connect with Facebook or Google, insert data manually).

We mimic the interaction between the user and the broker.

03

User tests

The panel

5 people from 25 to 50 years old

2 Locals and 3 expats

3 men and 2 women

- Low km drivers (less than 20.000 km per year)

- Minimum secondary education required – to guarantee good communication skills that will give us actionable insights

- Everybody requested to use both smartphones and laptops to make online purchases

- People who own a car, or make car policy’s buying decision

- People who normally do purchases online

- People who drive for work or for leisure

- Expats and locals

- People who was going to purchase a car insurance policy in the upcoming 3 months

- People who rated themselves a 7+ on a ‘tech-savvy’ scale

Results

Users were still a bit confused about PPK and cashback, but they understood how the concept works.

Steps reduced from 18 to 12, and positive feedback increased by 25%

We used a severity scale to organize feedback. Some of the most severe feedback was useful to improve the user experience of the funnel

04

Filling the gaps

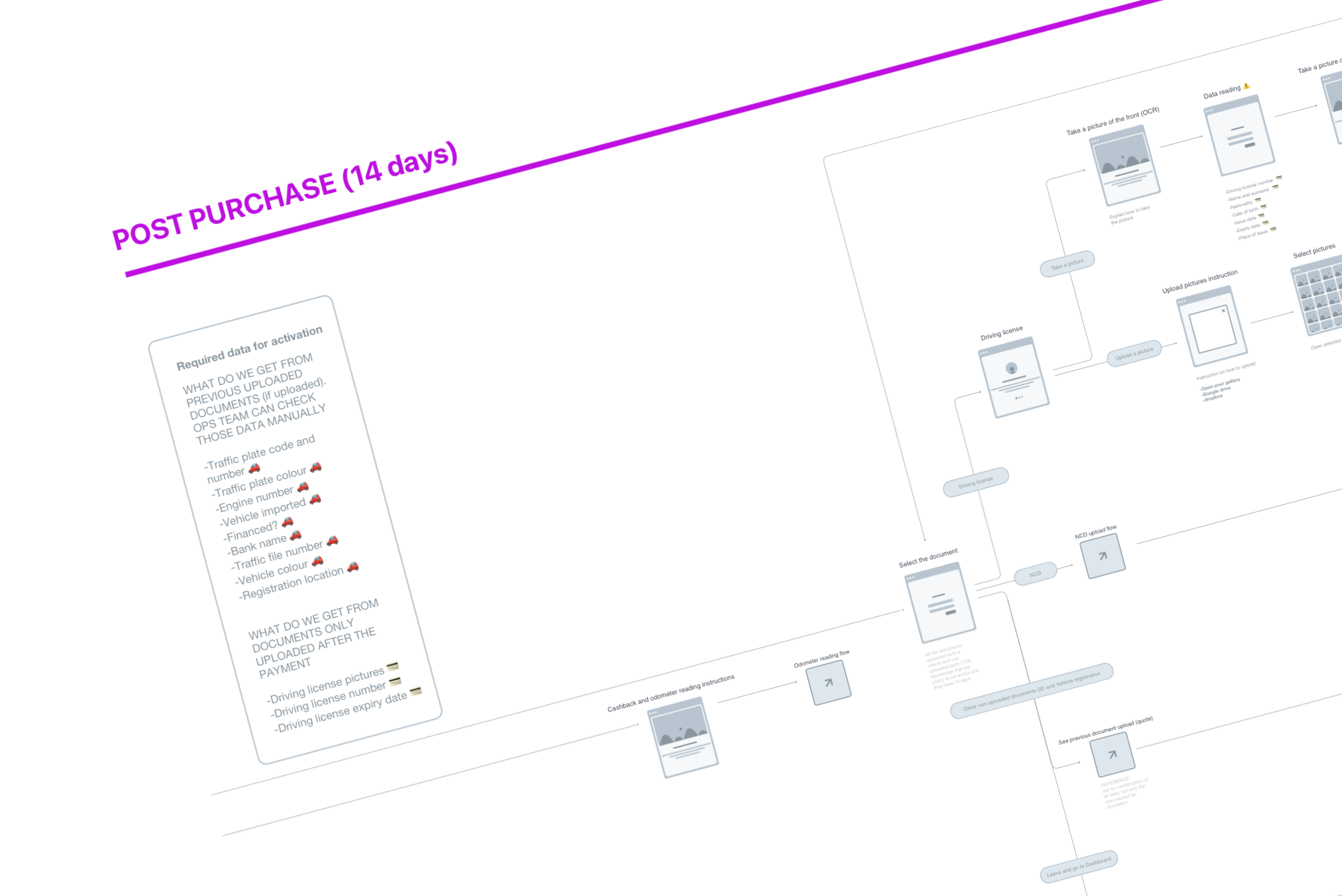

Evolution of the flow

After collecting the results from user testing, we designed a wider blueprint, including all possible paths, KO and scenario. In less than 2 months we were ready to launch the flow, both for mobile and desktop.